The world has changed, and companies have been forced to adapt to new business models to reach market and consumer needs. Entrepreneurs and businesses are rushing to get involved in what is a potentially very profitable market and the e-commerce is a new channel to follow a new path to increase sales.

Numbers are already showing this shift. According to a latest research from Google, European companies are searching that 71% of European consumers are already buying cross-border. The same report announces that European business are planning to invest in e-commerce and digital transformation in the next 12 months.

If you are one of those companies, do make sure you do the obvious market analysis, to have the valuable insights to define a strategic digital action plan to clarify where to go, how you will do it and allocate a specific budget to achieve your goals.

Furthermore, it is also very important you are updated on the legal and tax rules and evaluate the most effective way to handle your operations.

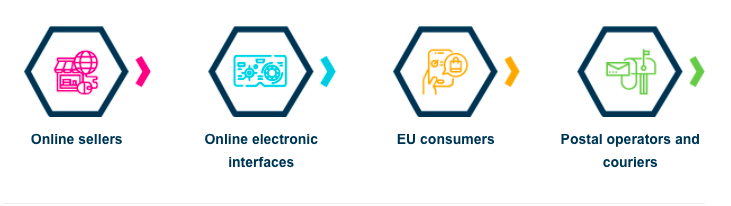

From 1 July 2021, the VAT rules on cross-border business-to-consumer (B2C) e-commerce activities will change in the EU. The main changes are the following:

1.Registering with the new One Stop Shop (OSS).

Online sellers, including online marketplaces and platforms can register in one EU Member State only and this will be valid for the declaration and payment of VAT on all sale and cross-border of services to customers within the EU.

Thus, EU companies will benefit from a reduction of bureaucratic obstacles as there will be no need to register in each Member State as it used to happen. Now companies will be able to manage all your VAT obligations from their country of residence.

2. Harmonized threshold of 10.000 EUR

All sales of goods within the EU will be subject to a new EU-wide threshold of EUR 10 000. This means that when your sales in a specific country reach over 10.000 EUR, you will be subject to the VAT of the Member State where the sales are generated. Instead, if sales are lower, your sales remain subject to VAT in the Member State where your company is established.

3. VAT will apply to all goods imported to Europe.

The VAT exemption at importation of small consignments of a value up to EUR 22 will be removed. This means all goods you import from third countries to the EU will subject to VAT. To simplify the the declaration and payment of VAT, there is also the Import One Stop Shop (IOSS).

The rule applies to the complete the e-commerce supply chain, so marketplaces like Alibaba or even couriers will be affected to the new rules.

In conclusion, steps to meet your tax obligations should become faster and more efficient within the EU markets.

For more information, contact us.